How To Open IPPB Digital Savings Account Online?

Indiapost Payments Bank (IPPB) offers 3 types of savings accounts.

IPPB Digital Savings account can be opened at the convenience of your mobile phone. There is no need to go to post office for opening this account. Sounds nice isn't it? Just download the IPPB Mobile app and the rest is pretty straight forward. For opening the other two types of accounts we need to go to the post office.

The good thing in these accounts is that there is no minimum balance to maintain in the account. There is no monthly average balance required to be maintained and the account can be opened with zero balance. There are also many other attractive features to these accounts one of which is door step banking. Just raise a request via your mobile and a bank official will come to your home to complete your transaction. It's pretty nice actually if you think about it.

But lets get into the topic of how to open IPPB digital savings account online. Below are the steps to follow.

- Keep your Aadhar and PAN Card ready with you. You will need them.

- Go to play store and search for IPPB Mobile Banking or you can follow this link to download the app.

- Click on Open Your Account (New) link on the home screen.

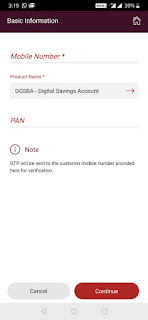

5. Upon clicking the continue button, an OTP will be sent to your mobile number to verify the mobile number. Enter the OTP after you receive it.

6. In the next screen you have to enter your Aadhar number. Click on "I DO NOT HAVE AADHAR BASED OTP ACCOUNT WITH ANY BANK" and "I HEREBY GIVE CONSENT FOR AUTHENTICATION FOR OPENING OF ACCOUNT THROUGH OTP" check boxes. Then click on Submit button. You will get an OTP to the mobile number which is linked with your Aadhar number to verify the genuineness of the Aadhar number.

8. That's it you will get your IPPB Digital Savings account number and other details in the next screen.

Key Points to remember while opening a IPPB Digital Savings Account:

- Individuals must be above 18 years of age

- Complete the KYC formalities within 12 months

- KYC formalities can be done by visiting any of the access points (post office) or with the help of the Postman, after which the Digital Savings Account will be upgraded to a Regular Savings Account

- A maximum yearly cumulative deposit of Rs. 2 lakhs is allowed in the account

- The account is subject to closure if the KYC is not completed within 12 months of account opening

- The Digital Savings account can be linked to a POSA (Post Office Savings Account) after completion of KYC within 12 months.

You probably wanted to open an IPPB digital saving account to transfer money online to your Sukanya/PPF/RD accounts. Click on the links to know the step by step procedure.