FINACLE

TRAINING LESSON 14

Also Read : Finacle Training Lesson 13

Also Read : Finacle Training Lesson 13

Recap:

In the

previous lesson, we have learned in detail about interest withdrawal process

(reversal transaction). In today’s lesson we will learn about how to credit the

interest amount in customer SB account.

Interest payment by crediting to SB account or by RBI cheque.

In many cases interest

credited in sundry account will be more than 20,000. For example in SCSS and TD

interest amount in many cases will be much more than 20,000.

As per POSB rules we

cannot pay any amount 20,000 as cash. So in such cases we have to transfer the

interest amount either to customer’s SB account or to

Repayment account {0340}.

We will transfer the

amount to customer’s SB account if customer has an SB account and we will

transfer the amount to Repayment account {0340} if payment is made by RBI

cheque.

Follow carefully now. We

know that in Finacle every transaction has a Credit entry and a Debit entry. In

the previous transaction where we have done interest reversal

by cash, Sundry account was debited and Teller account was credited.

But here we have to

credit either customer’s SB account or Repayment account {0340}. Let’s see how

it is done.

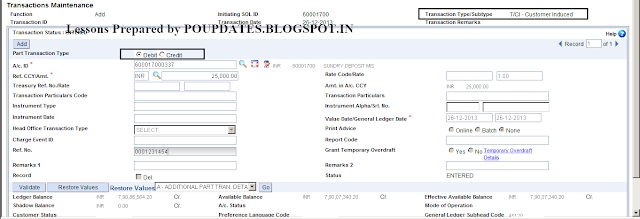

Invoke HTM, choose

function as Add and Transaction Type/Sub Type as

T/CI Customer Induced and click on Go. See the image below.

After Clicking on Go you will see the

screen as shown below.

Observe the fields which I have put in a box in the above image.

What did you observe? Part Transaction Type is selected as Debit. Have you ever

encountered this word “Part Transaction”? Yes many of you should have seen this

error “Part Transaction already posted”. Have you ever wondered what a part

transaction is? You will know the answer now.

I shall repeat once again

all transactions in finacle we will have a debit entry and a credit entry. Even

while doing transactions using CTM, CRDP, CPDTM etc debit and credit

transactions will take place in the background.

They have created these

customized menus to help us from not getting confused due to debit and credit

entries. In CTM, CRDP, CPDTM etc C stands for Customized. It means these menus

are created especially for DOP. In HTM, HACLI, HFINRPT etc H stands for

Hypertext. All default Finacle menus start with H. Those menus which are

specially designed for us start with C.

For your information I

will tell you that we can do all transactions like SB deposit/Withdrawal, RD

deposit, PPF deposit, etc using HTM menu itself. But you should know the

correct debit and credit accounts.

Now coming back to our lesson, to transfer interest from

Sundry to SB account we know that Debit account is Sundry account and credit

account is customer’s SB account.

To transfer interest from

sundry to SB account, there are 2 steps involved. In the first step we debit

the sundry account and second step we credit the customer SB account or

Repayment account.

These steps are called as

Part Transactions. So technically we should say, in the first part transaction

we debit the sundry account and in the second part transaction we credit the

sb/repayment account.

It is not mandatory that

the first part transaction should be debit only. If you are comfortable enough

to play with debit and credits you can do any part

transaction first.

If you observe in the

interest withdrawal by cash in the previous lesson we only debited the sundry

account. It doesn’t mean that there is no credit transaction. Credit

transaction took place without our knowledge in the background.

Hope you are getting my

point.

Coming back to our actual transaction let see what we

should do.

In

the first step we debit the Sundry account. This process is same as we have

done in the interest withdrawal by cash transaction. Let’s quickly see the

steps involved.

1. Function

– ADD

2. Transaction

Type/Sub Type – T/CI Customer Induced

3. GO

4. Enter

Sundry account number

5. Enter

amount

6. Enter

actual MIS/TD/SCSS account number in ref number

7. Click

on GO

8. Enter

actual MIS/TD/SCSS account number in ref number again

9. Click

on GO

10. Tick

the entry and click on Accept

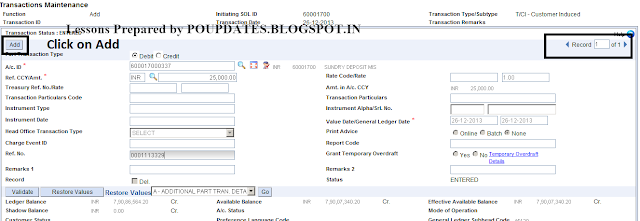

After

clicking on Accept you will be taken to the first screen again. Wait don’t

click on Post. For interest payment by cash we just clicked on Post to complete

the transaction.

But here we completed only

half of transaction. Only one part transaction is completed. To do the second

part transaction click on ADD, as shown in the figure.

After

Clicking on ADD button you will get the same screen with empty fields again.

This means you have to enter second part transaction details here. Second part

transaction details is nothing but entering the credit account id and amount.

Enter

the customer account id and amount change the part transaction type to Credit.

That’s

it. Click on Post. Your transaction is over. Amount will transferred to either

customer’s SB account or Repayment account.

Read

this lesson and the step by step procedure in our book Pineapple you will

understand very clearly what is happening behind the scenes.

Hope

you have understood this lesson.

The

procedure is same for MIS/TD/SCSS accounts. Only the sundry account number will

change.

That’s

all for now see you tomorrow, same time same place.