FINACLE TRAINING LESSON 12

Also Read : Finacle Training Lesson 11

Recap:

In the previous lesson we have

studied in detail about PPF deposits. In this lesson we will learn about

interest withdrawal procedures.

I recommend you to please read all

the lessons before this lesson once again so that you remember well. From this

lesson things will become a little tough. It’s important that you have

everything in mind about what is taught till now.

Importance of Saving Accounts.

You guys might have

observed in Banks, that if we go to make a fixed deposit they will first tell

us to open a SAVINGS ACCOUNT. They will not accept any transaction from us

until we open a savings account in their bank.

But that practice is not

there in our post offices. If a customer comes for RD account we will open it

without forcing the customer to open SB account. Same is the case for other

account openings also.

I don’t say that the

procedure we follow in our post offices is wrong, but it is not correct also.

Since in this technologically advanced periods opening a Savings account will

save lot of time and energy of counter staff. Wait do you think I have typed

wrong by saying counter staff? Do you think opening of Savings account will

only benefit customers? No absolutely not!

If customers open Savings

accounts, then it will hugely reduce our work in the counters. Yes it’s true.

You will know why I’m saying this after I complete this lesson.

If customer has a saving

account, all the interests from MIS/TD/SCSS accounts will automatically get

credited in the customers SB account. Customer can then withdraw the amount

without coming to post offices also.

Yes they can withdraw the

amounts from ATMs, they can transfer the amount using our Internet banking

services, and they can use our mobile apps to make transactions. All these

alternate ways of doing transactions are called as CHANNELS. So using different channels

provided by Finacle, customers can complete their transactions without coming

to post office also.

So since customers are

not coming to post office to make all transactions, there will be huge relief

for the entire counter PAs. So what we recommend is let’s work hard this one

year and try to open SB accounts to all the existing customers. Even for new

customers let’s first encourage them to open SB account before we do any other

transactions.

Even in BOs thousands of

accounts are opened. For 100 rs ten accounts are opened. Even for those

accounts if you can open SB accounts and auto credit RD account from SB

accounts, offices with BOs will be hugely relieved from work.

Now since we don’t have

this practice of opening of SB accounts in office we will see the difficulties

one by one.

Interest withdrawal transactions.

In case of SB withdrawal

we would simply invoke CTM, enter account id and amount and click on submit.

That’s it transaction is over. But here interest withdrawal is a lengthy

process.

I hope you remember in

the lesson 7 and 8 we have discussed about office accounts. If you don’t

remember please refer to those lessons once.

In case of MIS/SCSS/TD

the interest which is due every month/quarter/year will be automatically

deducted from the respective account on the due date. This interest amount from MIS/SCSS/TD

should actually be credited into the SB account of the customer. If it is

auto credited to SB account we can use CTM to simply withdraw the amount from

SB account.

But for those MIS/SCSS/TD

accounts where SB accounts are not available the interest amount which is due

will credited into the respective SUNDRY ACCOUNTS.

For example, MIS interest

which is due every month will be credited into MIS Sundry account (SOL ID+0337)

on the due date.

Similarly SCSS interest

which is due every quarter will be credited into SCSS Sundry account (SOL

ID+0338) on the due date.

Finally TD interest which

is due every year will be credited into TD Sundry account (SOL ID+0335) on the

due date.

Even for 1 year TD

interest will be credited into TD sundry account on the date of maturity.

So the interest amount

which is due in MIS/SCSS/TD accounts is actually should be withdrawn from

MIS/SCSS/TD sundry accounts.

I hope you are getting my

point.

MIS interest is withdrawn

from MIS sundry account, SCSS interest is withdrawn from SCSS sundry account

and TD interest is withdrawn from TD sundry account.

This process of

withdrawing interest from respective sundry accounts is called as Interest Reversal. Interest is already withdrawn and

credited into sundry account; we have to reverse this transaction from sundry

account to make the payment to customer.

So let’s see how the

reversal process is done.

Invoke the menu HTM and

you will see the following screen. See the image below.

In this screen also we

have to Choose Function Code and Transaction Type/Subtype. Here in HTM

transaction type means whether you are making payment by cash or making payment

by transferring the amount to customer’s POSB account or making payment by

giving RBI cheque.

For making cash payments

we have to select Transaction Type/ Subtype as C/NP – Cash/Normal

Payment.

For payments by transfer

to POSB accounts and payments by RBI cheque please select Transaction Type/

Subtype as T/CI Customer Induced.

We will see about the

last option C/CT – Cash/Cash Transfer later. It is not used in interest

withdrawal transactions.

So let’s do an MIS

withdrawal transaction by cash first, and see how the process takes place.

So choose Function Code

as ADD, and select Transaction Type/ Subtype as C/NP – Cash/Normal Payment

since we are making interest payment by cash and click on GO. You will get the

screen as shown in the image below. See the image below.

As you can see in the

above image the form seems very complicated. For your information I’ll tell you

that we can do all transaction like SB dep/wdl, RD dep, PPF dep etc can be done

in HTM menu. But you need to know how to enter the correct debit and credit

entries. Don’t worry we already have easy menus for those transactions.

In this screen there are

so many fields. But the good news is you have to enter only 3 fields as I have

shown in the image

Enter A/c ID as MIS

Sundry account ID. (SOL Id +0337). Then enter the amount and lastly enter the

actual MIS account number in Reference number field.

How to check the

signature for making withdrawal then? Simple! If you want to check the

signature of the customer, before entering the MIS sundry account ID in A/c Id

field enter the actual MIS account number and press F9. System will show you

the signature when you press F9. After confirming the signature delete the

actual MIS account id in the A/c id field and then again enter the MIS Sundry

account ID.

So

1. Enter MIS sundry ac

number in A/c Id field.

2. Enter the amount in the

Ref.CCY/Amt field. (Ref CCY means Reference currency. Since we are doing all

transactions in rupees Ref.CCY will always be INR (Indian Rupees))

3. Enter actual MIS account

number in Reference number as shown in the image.

4. Click on GO

Why click on GO instead

of POST? In previous transactions we never clicked on GO. Let me explain why.

MIS sundry account will

have deposits related to all those MIS accounts which do not have SB accounts

linked to them. So while making reversal transaction from Sundry accounts we

have to clearly mention about which MIS account, the reversal is taking place.

So to tell Finacle about which MIS account we are making the reversal we have

to enter some details which are called as ADDITIONAL PART TRANSACTION DETAILS.

If you see in the image it

is already selected as Additional Part Tran Details. So when we click on GO a

new screen will open where we can give the additional part transaction details

about the transaction which we are doing.

So after you click on GO

a new screen will appear as shown in the below image. See the image below.

The screen which we see

above is the search screen. In MIS Sundry account there will be thousands of

transactions relating to all those MIS accounts which do not save auto credit

to SB. So to make it easy for us, a search screen will appear. Using this search

screen we will search for that MIS interest transaction which was credited in

MIS sundry account on the interest due date.

Before that Lets first

know about the important terms in this screen

In this screen we are

searching for all those transactions with reference to actual MIS account in

MIS sundry account where transaction amount starts from 2000 to 2000.

Please understand the

above statement carefully. If you see the image we have fields like START AMT,

END AMT, REF NO, and FILTER.

We enter the actual MIS

account number again in ref no field and Start amt, End amt fields

automatically the amount which we entered in the first screen will come.

So what actually

happening is System will search in MIS sundry account for transactions related

to the MIS account which we entered in Ref no.

Sometimes an error will

come as shown in the figure below.

I think many of you will

be familiar with this error. When we get this error we simply delete the start

amt and end amt. But why should we delete them?

The reason we are getting

this error is, there are no transactions with reference to the MIS account

number in Red No in sundry account where amount is 2000.

I hope you are getting my

point.

So let’s say first we

delete only Start amt. See the image below.

Since we have deleted

Start amt. Finacle will now search for all those transactions in MIS sundry

account with reference to the actual MIS account whose amount starts from 0 to

2000.

I hope you are following

the point

Similarly let’s try

deleting End amount and let’s see what finacle will do. See the image below.

When we delete the end

amount Finacle will now search for all those transactions in MIS sundry account

with reference to the actual MIS account whose amount starts from 2000 and it

will show all transactions above 2000.

I’m sorry but this is all

necessary. I know it’s a bit confusing. But to become an expert you should know

all this stuff.

Now what will happen if

we delete both Start amt and End amt? The answer is simple. Finacle will search

for all the transactions in MIS sundry account with reference to the actual MIS

account.

If you are getting

confused, try these steps at your office. Try deleting Start amount once and

End amount and both. See what happens. Check for different accounts. You will

slowly understand what I’m trying to say.

Let’s complete this

transaction first.

In the second screen just

enter the Ref no and click on GO. The following screen will appear. See the

image below.

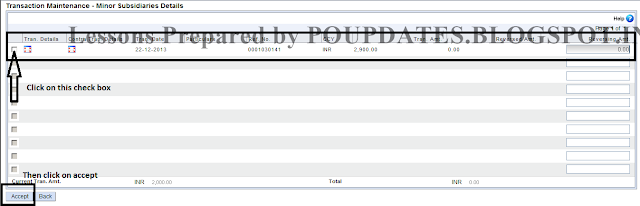

In this screen we will

see that interest entry which was deposited in MIS sundry account. To complete

the transaction just click on the check box as shown in the image and click on

accept.

Oh my god this single

transaction is taking so much time to explain and the bad news is there is

still so much to explain.

We will continue about

this transaction in the next lesson. I request all of you to please read this

lesson and the next lesson tomorrow so that you get good grip on all HTM

transactions.

See you tomorrow.

Click

here to continue reading this

topic.

Also Read : Finacle Training Lesson 13